The fragmentation problem in crypto trading has gotten worse, not better. You’re managing balances on Ethereum, Arbitrum, Base, and Optimism. Each chain needs separate gas tokens. Bridging takes time and costs money. Your capital sits idle across networks while opportunities flash by on chains where you have no liquidity.

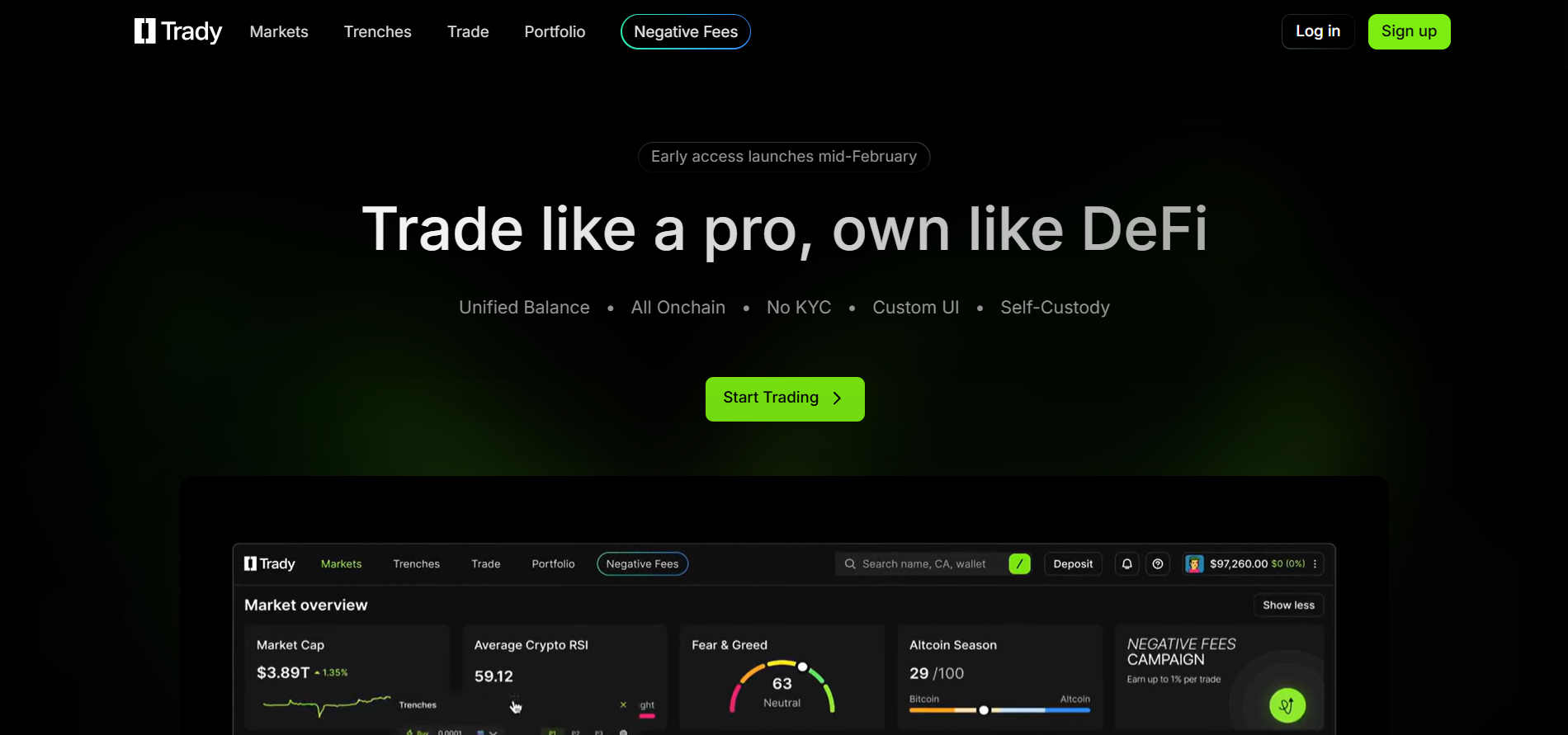

Trady addresses this problem directly. It’s a cross chain trading platform that shows you one balance per token across all networks.

When you want to trade, it handles the complexity behind the scenes. No manual bridging. No wondering which chain holds your USDC. Just unified balances and instant execution.

The Multi-Chain Problem Nobody Solved

Most trading platforms picked a side. Centralized exchanges ignore chains entirely, you trade IOUs in their database. Decentralized exchanges serve one chain well but leave you stranded when liquidity moves elsewhere.

The result is capital inefficiency. You keep $10,000 USDC on five different chains hoping to be ready when opportunities appear. But when that perfect setup shows on Arbitrum, your USDC sits on Base. By the time you bridge over, the opportunity’s gone.

Cross-chain bridges helped somewhat, but they’re clunky. Each bridge transaction costs gas on two chains. Transfers take minutes to hours. You’re constantly moving money around, paying fees, waiting for confirmations. It’s exhausting and expensive.

How Trady Actually Works?

Trady’s approach differs from both centralized and traditional decentralized platforms. You connect your wallet, no account creation, no KYC, no uploading documents. Your assets stay in your wallet the entire time.

When you view your portfolio, Trady aggregates balances across all supported chains. Hold 1,000 USDC on Arbitrum and 500 on Base? You see 1,500 USDC total. One number, accurate in real-time.

Trading happens through this unified interface. Want to buy ETH with your USDC? Select the pair and amount. Trady’s routing engine finds the best execution across chains and DEXs, handling any necessary cross-chain steps automatically.

The platform uses account abstraction and smart routing. Your wallet authorizes actions through session keys with spending limits you control. No need to sign every transaction manually. No giving up custody to a centralized entity.

Key features:

- Unified balance view across all chains

- One-click cross-chain swaps without manual bridging

- Non-custodial throughout, assets never leave your control

- MEV protection preventing front-running

- Real-time risk scoring for tokens and contracts

Why This Matters for Active Traders?

Active trading demands speed. You spot a setup, you enter. Hesitation costs money. Traditional multi-chain workflows kill speed.

Consider a typical cross-chain trade without Trady:

- Check which chain holds your capital (2 minutes)

- Navigate to bridge interface (1 minute)

- Approve tokens for bridging (1 transaction, 30 seconds)

- Execute bridge (1 transaction, 5-20 minutes)

- Switch to destination chain DEX (1 minute)

- Approve tokens for trading (1 transaction, 30 seconds)

- Execute trade (1 transaction, 30 seconds)

Total time: 10-25 minutes minimum. You’ve paid gas on two chains plus bridge fees. The opportunity is likely gone.

With Trady:

- Select trading pair and amount

- Confirm transaction

Total time: 30 seconds. Single gas payment. Opportunity captured.

This efficiency matters most during volatile periods when opportunities appear and disappear quickly. Being able to act immediately while others fumble with bridges creates genuine edge.

The Security Model

Non-custodial trading platforms face a key challenge: balancing security with usability. Too much friction (signing every action) kills user experience. Too little friction (giving platforms control) kills security.

Trady uses session keys with granular controls. You authorize the platform to execute trades on your behalf within limits you set. Maximum transaction size, daily spending caps, allowed contract interactions, you define the boundaries.

These sessions expire automatically. If you set a 24-hour session, permissions lapse after that period. You need to reauthorize for continued trading. This prevents compromised sessions from causing indefinite damage.

The platform never holds your assets. Everything executes directly from your wallet. If Trady’s interface disappeared tomorrow, your funds remain safe in your wallet. This contrasts sharply with centralized exchanges where platform failure means potentially losing everything.

Real-time risk scoring adds another security layer. Before executing trades, Trady analyzes the tokens and contracts involved.

Newly deployed contracts with suspicious characteristics trigger warnings. Tokens exhibiting scam patterns get flagged. You still control whether to proceed, but you’re making informed decisions.

Who Benefits Most

Trady serves traders who value ownership but need professional tools. If you’re comfortable with wallets and private keys, tired of managing assets across chains, and want execution quality approaching centralized exchanges, this platform fits.

Active traders benefit from unified liquidity access. You’re not fragmented across chains. Your full capital is available for any opportunity regardless of which chain it appears on.

Privacy-conscious traders benefit from no KYC. Connect wallet, start trading. No documents, no verification delays, no trusting platforms with personal information.

DeFi natives benefit from composability. Trady integrates with the broader DeFi ecosystem. Positions taken on Trady can interact with lending protocols, yield aggregators, and other DeFi primitives because everything stays on-chain under your control.

What Still Needs Work?

Being honest about limitations matters. Trady is powerful but not perfect for everyone.

Fiat on-ramps remain limited. Getting dollars into crypto still mostly requires centralized exchanges. Trady focuses on crypto-to-crypto trading. If you’re converting paychecks to crypto regularly, you’ll still need traditional exchanges for that step.

The learning curve is steeper than simple centralized platforms. Understanding wallets, gas, and self-custody takes effort. If you want maximum hand-holding and don’t mind giving up control, centralized exchanges still win on simplicity.

Liquidity aggregates from DEXs, which means liquidity depth varies. Centralized exchanges with their order books sometimes offer better execution on very large trades.

The Bigger Picture

Trady represents where trading platforms are heading. The false choice between centralized control and fragmented self-custody is dissolving. Technology now enables maintaining full ownership while accessing unified liquidity and professional tooling.

This matters beyond individual convenience. Censorship resistance requires genuine decentralization. Platforms holding user assets can freeze accounts, block transactions, or disappear with funds. Non-custodial platforms can’t do any of that.

As crypto matures, more users will demand control without sacrificing usability. The early days required accepting poor UX for decentralization.

That tradeoff is ending. Trady shows what becomes possible when product design prioritizes both ownership and experience equally.

Getting Started

Visit trady.xyz and connect your wallet. MetaMask, WalletConnect, and most major wallets work. No signup forms, no verification queues.

Start small to understand the interface. Execute a small swap to see how unified balances work. Test cross-chain trading with amounts you’re comfortable losing to errors.

Review session key settings. Understand what permissions you’re granting and what limits you’re setting. Start conservative, you can always expand limits after you’re comfortable.

Monitor your first few trades closely. Watch how routing works, where execution happens, how gas costs compare to your usual workflow. This data informs whether Trady fits your trading style.

The cross chain trading platform landscape is evolving quickly. Trady offers a glimpse of where things are going, unified, non-custodial, and built for actual trading rather than just ideological purity. Whether it becomes your primary platform depends on your priorities, but it’s worth understanding what’s now possible.