In today’s digital-first economy, business decisions are increasingly made at speed — and often based on limited data.

Whether onboarding new clients, evaluating partnerships, approving financial transactions, or assessing leads, companies rely heavily on contact data such as phone numbers and email addresses.

Yet these simple data points can reveal much more than most organizations realize.

Modern phone and email lookup technologies are becoming powerful instruments for fraud prevention, compliance, and operational efficiency.

Services like ClarityCheck are helping businesses turn minimal contact information into actionable intelligence that supports safer, smarter financial decisions.

Why Contact Data Matters in Business and Finance?

A phone number or email address is often the first — and sometimes only — identifier a company has when interacting with:

- New customers

- Freelancers or contractors

- Marketplace sellers

- Potential investors

- Loan applicants

- B2B leads

In digital commerce, these identifiers function as a gateway to trust.

However, cybercrime and financial fraud continue to rise globally. Fraudsters frequently use:

- Disposable email addresses

- VoIP numbers

- Recycled or masked phone numbers

- Synthetic digital identities

Without proper verification, businesses risk financial loss, reputational damage, and compliance violations.

The Growing Cost of Digital Fraud

According to industry research from organizations such as Federal Trade Commission and Europol, identity-based fraud and online scams have increased significantly over the past decade.

Common risks include:

- Account takeover fraud

- Fake vendor onboarding

- Phishing-based payment redirection

- Chargeback abuse

- Synthetic identity fraud

For financial institutions, fintech startups, and e-commerce platforms, even a small percentage of fraudulent transactions can erode margins quickly.

From Raw Data to Business Intelligence

A professional lookup service analyzes contact information to generate insights such as:

- Owner name (where legally available)

- Carrier and line type (mobile, landline, VoIP)

- Risk indicators

- Associated public records

- Digital footprint signals

This transforms a basic phone number or email address into a risk assessment layer.

Practical Example

Imagine a fintech platform reviewing a high-value loan application. The applicant provides:

- A recently created email

- A VoIP-based phone number

- No digital footprint

Without additional checks, approval may expose the company to fraud.

With a lookup analysis, risk signals can be flagged before funds are disbursed.

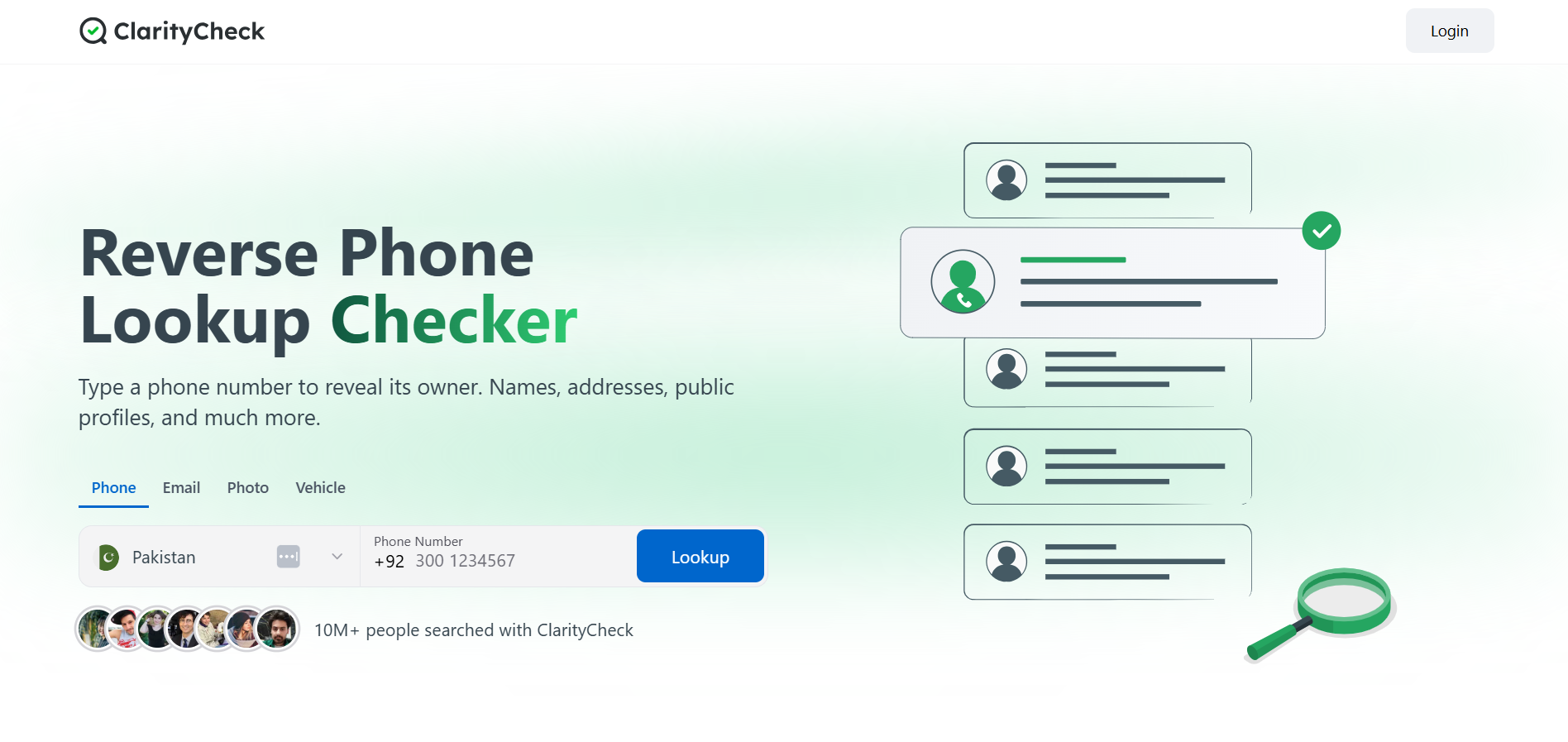

Introducing ClarityCheck

What Is ClarityCheck?

ClarityCheck is a digital intelligence service that enables users to search for publicly available information connected to phone numbers and email addresses.

Businesses use it for:

- Pre-transaction screening

- Lead validation

- Vendor verification

- Customer due diligence

- Internal investigations

You can learn more directly via the official platform here: 👉 Clarity Check

Key Features for Business Users

1. Phone Number Lookup

- Carrier identification

- Line type detection (mobile, landline, VoIP)

- Risk signals

This helps determine whether a contact number is likely legitimate or potentially disposable.

2. Email Address Intelligence

- Domain verification

- Age indicators

- Public digital presence signals

For online marketplaces and SaaS companies, email legitimacy can be a major trust indicator.

3. Risk-Oriented Insights

Instead of just providing raw data, modern lookup services interpret signals to support business decisions.

Business Use Cases Across Industries

1. Fintech and Lending

Financial technology companies operate in a highly regulated environment. KYC (Know Your Customer) and AML (Anti-Money Laundering) frameworks require proper identity validation.

Contact intelligence tools support:

- Early fraud detection

- Reduced loan default risk

- Improved underwriting accuracy

2. E-Commerce and Marketplaces

Online sellers face constant threats of:

- Fake buyer accounts

- Refund abuse

- Chargeback fraud

Phone and email screening provides an added protection layer before shipping goods or approving refunds.

3. B2B Sales and Lead Qualification

Marketing teams often purchase or generate large lead lists. However, low-quality or fake leads waste time and budget.

By validating contact data:

- Sales teams focus on real prospects

- Bounce rates decrease

- Conversion efficiency improves

Financial Impact: Prevention vs. Recovery

| Factor | Without Lookup Tools | With Contact Intelligence |

| Fraud Detection | Reactive | Proactive |

| Investigation Cost | High | Lower |

| Decision Speed | Slower (manual checks) | Faster (automated insights) |

| Reputational Risk | Higher | Reduced |

Prevention is significantly less expensive than post-fraud recovery. For scaling digital businesses, integrating intelligence tools into workflows can generate measurable ROI.

Compliance and Regulatory Considerations

In regions governed by frameworks such as:

- GDPR in Europe

- KYC/AML regulations globally

- Consumer protection laws

Businesses must ensure that data usage aligns with legal standards.

Professional lookup services typically rely on publicly available and legally accessible information. However, companies must always:

- Use data ethically

- Respect privacy laws

- Implement transparent compliance policies

How Contact Intelligence Supports Strategic Decision-Making

Beyond fraud prevention, lookup services provide strategic value.

Risk Scoring for Partnerships

Before signing partnership agreements, companies can:

- Validate executive contact data

- Confirm business legitimacy signals

- Reduce exposure to shell entities

Investor and Vendor Due Diligence

When reviewing new vendors or minor suppliers, quick contact verification can:

- Confirm operational authenticity

- Flag inconsistencies

- Support procurement risk policies

The Future of Digital Identity in Finance

As artificial intelligence and automation expand, digital identity verification will become even more critical.

Trends shaping the future include:

- AI-powered fraud detection

- Behavioral analytics

- Cross-platform identity correlation

- Real-time risk scoring

Phone numbers and email addresses will remain foundational identity anchors — but the intelligence derived from them will grow increasingly sophisticated.

Services like ClarityCheck represent part of this broader movement toward smarter, data-driven risk management.

Final Thoughts

In the digital economy, information asymmetry is one of the biggest risks businesses face. A single fraudulent transaction, fake partnership, or synthetic identity can trigger financial and reputational damage.

Phone and email lookup tools provide:

- Faster due diligence

- Stronger fraud prevention

- Improved operational efficiency

- Better financial decision-making

For businesses operating in fintech, e-commerce, marketplaces, or B2B sectors, integrating contact intelligence into risk workflows is no longer optional — it is becoming a competitive necessity.

By transforming simple contact data into actionable insight, platforms like ClarityCheck help companies operate with greater confidence in an increasingly complex digital financial landscape.