Every day expenses can feel endless. From groceries to gas, small purchases add up fast. But what if your daily spending could work for you instead of just draining your wallet? That’s where cashback cards come in.

With each swipe, you’re not only paying for goods but earning something back. A cashback debit card (tarjeta de débito) allows you to collect rewards on purchases you already make. This article explores how these cards enable everyday spending to become a consistent source of savings without disrupting your routine.

Everyday Spending That Builds Value

Most people don’t realize how much they spend on everyday items. Coffee, snacks, and personal care products are everyday purchases. These small expenses repeat weekly, sometimes daily. Over time, they create a steady cash flow.

Using a card with cashback benefits on those items allows you to earn back a percentage of each transaction. The more consistent your spending, the more rewards you accumulate. Even buying household goods can earn rewards automatically. This system rewards routine behavior, not extra effort.

Online Shopping Works Too

Cashback rewards aren’t limited to physical stores. Many cards also offer benefits on digital purchases. Clothing, electronics, and personal items bought online can qualify. That makes your rewards track across both in-person and virtual spending.

Most people shop online on a weekly or monthly basis. Whether you’re replacing shoes or buying a gift, it counts. As long as you use your qualifying card, the rewards apply.

This makes your digital habits more rewarding. You can shop from your phone, tablet, or laptop and still earn.

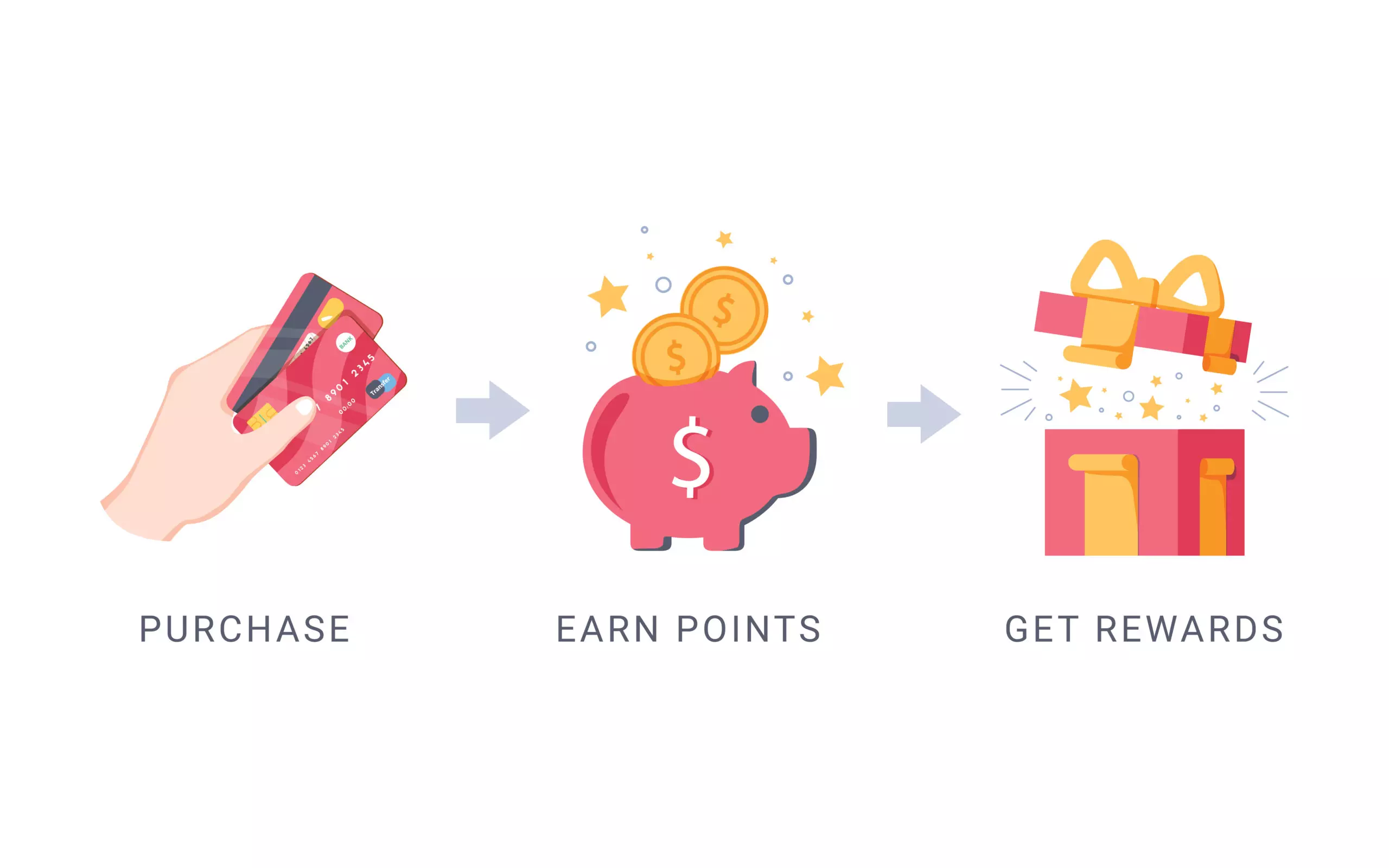

No Complicated Points or Redemptions

Some programs use points, which can be confusing. You may need to convert them or meet redemption rules. Cashback, on the other hand, is easy to understand. You spend, and you get money back; it’s straightforward. Instead of juggling balances or expiration dates, your reward comes directly to you.

That could be a deposit, a statement credit, or a balance increase. It’s real money you can use however you want. This clarity helps people focus on spending wisely.

They don’t need to manage another account or learn a complicated system. The rewards appear as you progress. It turns financial tools into something practical and user-friendly.

Works with Essential Services

Cashback rewards can be applied to services such as dining, gas, and public transportation. These categories are part of most households’ regular budgets. Using the right card on these costs helps you save without thinking about it. A trip to the fuel station becomes more rewarding.

Even transit payments may offer a small bonus. These benefits build up quickly because they relate to everyday life. You don’t need to plan your spending around a deal.

You simply need to use your card when making a payment. Over weeks or months, your rewards grow from routine activities. It’s a quiet but steady way to save.

Earn Without Overspending

Cashback doesn’t require you to spend more; it rewards what you already do. The goal is to make your existing habits work in your favor. Unlike sales or promos, you’re not encouraged to buy more than you need.

This approach supports more intelligent financial behavior. It shifts focus from spending for savings to earning through necessity. Over time, you may become more conscious of how and where you shop.

Cashback cards offer a simple way to make purchases more rewarding. Every meal, item, or service becomes a chance to save. Using a debit card (tarjeta de débito) with cashback features turns regular spending into real gains. It’s a wise choice for anyone looking to earn while sticking to their budget.