Are you stuck at the mctrpayment.com card activation process? Then, you are at the right place.

Read on to get all the answers about the mctrpayment.com card activation process in 2023!

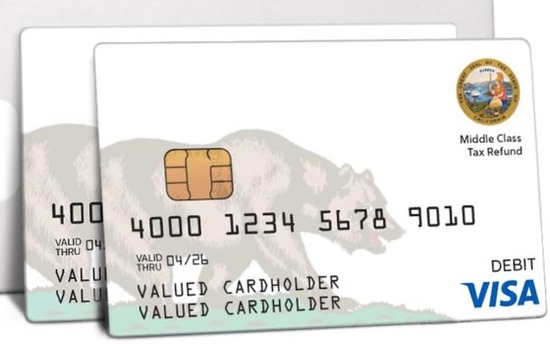

Activate mctrpayment.com Card

Activating your www.mctrpayment.com card is a straightforward process that can be completed in simple steps. It’s essential to follow these steps accurately to ensure your card is activated and ready for use.

This process is essential for new cardholders looking to use their card for various transactions, whether online or in physical stores.

How do you activate the mctrpayment.com card with the mctrpayment.com app?

Activating your card through the mctrpayment.com app is a convenient and quick method. Here’s a detailed breakdown of each step:

- Download the mctrpayment.com app: Start by downloading it from your respective app store, whether for iOS or Android.

- Open the app: Once installed, open the app and navigate to the main menu.

- Select ‘Activate Card’: You’ll find an option to activate your card in the app. Select it to begin the process.

- Enter Card Details: Input your 16-digit card number and the security code on the back of your card.

- Follow On-Screen Instructions: The app will guide you through several steps to verify your identity and secure your card.

- Set up a PIN: For security, you’ll be prompted to create a PIN for your card.

- Completion: Once you’ve followed all the steps, your card will be activated and ready for use.

How to Activate mctrpayment.com Card Online?

If you prefer activating your card online, here’s how you can do it through the official mctrpayment.com website:

- Visit the Official Website: Go to www.mctrpayment.com to start the process.

- Click ‘Activate Card’: On the website, there will be a dedicated section or link for card activation.

- Enter Card Details: Enter your card number and security code, similar to the app process.

- Additional Authentication: You may be required to complete extra security steps to verify your identity.

- Set a PIN: Setting up a PIN is a critical step for the security of your transactions.

- Activation Confirmation: After submitting all required information, your card will be activated and ready for use.

mctrpayment.com Card Activation Common Errors

While the activation process is designed to be user-friendly, you may encounter some errors. Here’s how to resolve them:

- Error: Incorrect card details entered.

- Solution: Ensure you enter the correct card number and security code. Double-check each digit for accuracy before submission.

- Error: Technical issues on the website or app.

- Solution: Sometimes, technical glitches can hinder the activation process. If this happens, wait a few minutes and try again. If the problem persists, reach out to mctrpayment.com customer support for assistance.

Conclusion

Activating your www.mctrpayment.com card is a crucial step to accessing its benefits. Whether you start it through the mctrpayment.com app or online, the process is designed to be user-friendly. However, be mindful of common errors and know how to address them.

If you encounter any difficulties, customer support is always available. With your card activated, you can enjoy its convenience and security for all your transactions.

FAQs

Q: What should I do if I encounter an error during activation?

Review the specific error message and follow the suggested solutions provided in this guide. If the issue persists, don’t hesitate to contact customer support for further assistance.

Q: Can I activate my mctrpayment.com card over the phone?

Currently, the primary methods for activation are through the mctrpayment.com app and website. If you prefer to activate over the phone or need assistance, contact customer support for guidance on available options.

Q: How long does it take for the card to be activated?

Activation is typically instantaneous. However, sometimes, it may take a few minutes for the process to complete. If you experience a significant delay, contact customer support for assistance.

Q: Is setting up a PIN mandatory during activation?

For enhanced security, setting up a PIN during the activation process is essential. This PIN will be required for certain transactions and adds an extra layer of protection to your card.