Fintechzoom simplifies the intricate mix of finance and technology for thorough market analysis. Tech enthusiasts eyeing Chevron Corporation stocks can benefit from insights provided by Fintechzoom.

Chevron Corporation is a strong performer in the stock market due to its efficient energy production and stable prices. Fintechzoom’s Chevron stock analysis helps investors make smart choices.

To understand how your stock investment might do, you should use Fintech’s tools to check stock performance.

Chevron is focusing on sustainable energy projects to manage market risks and challenges.

Investing in Chevron can be a good idea, but only if you look at its financial numbers and how the stock has done over time.

Now, let’s dive into the detailed analysis of fintechzoom chevron stock prediction to aid investors in making profitable decisions.

Getting To Know Chevron Corporation – A Brief History And Past Achievements

For those unfamiliar, Chevron Corporation is a leader in energy production. It’s a well-known American company that mainly deals with oil and gas.

Established in 1879 in California, Chevron has consistently met market demands effectively and continues to do so.

Over time, Fintechzoom’s analysis of Chevron Stock has shown significant growth. In 2023, Chevron stocks yielded a dividend of 3.94%. Currently, Chevron is regarded as a strong choice in the stock market.

Here’s a rephrased version:

Examining Fintechzoom Chevron Stock Prediction

Studying Chevron’s stock performance on Fintechzoom helps investors understand investments better. Fintechzoom analyzes stock performance by considering the latest market trends, reviews, and profit margins.

Fintechzoom uses various tools to evaluate stocks:

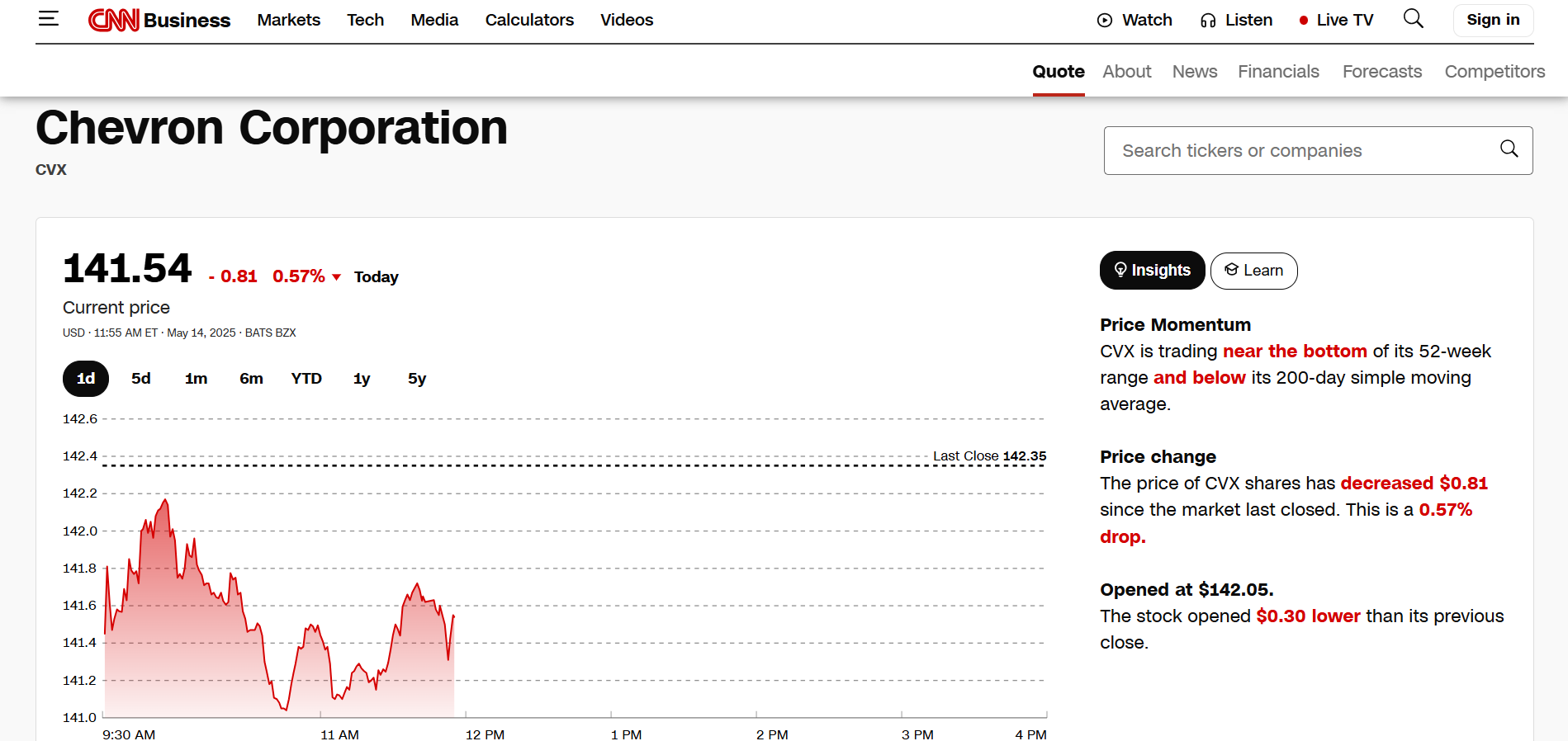

- Charting tools: These tools review performance charts to predict stock rate outcomes.

- Identifying support and resistance levels: Support levels indicate potential buying interest, while resistance levels show intense selling pressure.

- Using moving averages: Analyzing stock rates over a specific period, like 200 days or a year, helps determine their position.

- Technical indicators: Tools like RSI or MACD help gauge market volatility and stock price trends.

- Pattern recognition: Recognizing patterns like heads-and-shoulders or triangles aids in predicting future price trends.

Guide To Using Fintechzoom Chevron Stock Prediction

To understand Chevron’s stock performance, investors can rely on Fintechzoom strategies. Successful investing requires diligence and intelligence. Here’s a step-by-step guide:

- Review Expert Analysis: Before investing, check expert reviews from reputable sources like the International Energy Agency. They often have valuable insights into price trends.

- Consider Profit Margins: Look at Chevron’s earnings per share (EPS) and net income for a clearer picture.

- Evaluate Debt Ratio: Check Chevron’s debt ratio and dividend interest rate. This helps in planning your investment strategy.

- Compare Competitors: Compare Chevron’s market rate with its competitors. You might find better short or long-term investment opportunities elsewhere.

Understanding Chevron’s Financial Metrics

To craft a smart investment plan, it’s crucial to delve into a company’s financial metrics. Chevron, a multinational corporation, faces market fluctuations, so staying informed is key.

When assessing Chevron’s financial metrics, investors should look into:

- Revenue and Sales: Learn about the company’s income from oil and gas production.

- Market Volatility: Understand how Chevron’s stock prices fluctuate.

- Debt Ratio: Consider debt-to-equity ratio and interest coverage. A lower debt-to-equity ratio indicates a safer investment.

Analyzing these metrics helps gauge investment risks with Chevron and assess its market position.

Investing always involves risks, so it’s wise to understand the challenges linked with Chevron stocks before making decisions.

Investing in Fintechzoom’s Chevron Stocks poses the following challenges:

- Oil Price Fluctuations: Changes in oil prices directly impact Chevron’s stock prices.

- Regulatory Changes: Shifts in regulations and geopolitical dynamics can swiftly affect stock performance.

- Technological Advances: Innovations in energy sources or technology updates can influence Chevron’s stocks. Understanding projects like Chevron Energy sustainability can provide insights.

- Global Economic Factors: Worldwide recessions or inflation can cause stock rates to rise or fall.

- Reputation Risks: Negative reviews or reputation damage can significantly impact stock rates. Expert reviews and analysis play a crucial role in the stock market.

Summary

The assessment of Fintechzoom’s latest Chevron stock prediction underscores the indispensable role of technology in modern investment strategies.

Fintechzoom serves as a beacon for investors, offering simplified yet comprehensive analyses of market trends and stock performance.

Understanding Chevron Corporation’s rich history and achievements provides valuable context for assessing its current market position.

Despite the challenges posed by fluctuating oil prices, regulatory shifts, and technological advancements, Chevron remains a steadfast choice for investors, buoyed by its resilience and market performance.

By leveraging Fintechzoom’s tools and insights, investors can navigate these challenges with confidence, armed with a deeper understanding of Chevron’s financial metrics and the broader market landscape. If you’re someone who has just begun investing in the oil stocks, Brent crude oil stocks is another name that you might be considering investing in for which, FintechZoom’s expert analysis of Brent Crude oil prices will help you gain insights into market trends and make informed decisions.

Ultimately, strategic investments guided by Fintechzoom’s analysis present promising opportunities for those seeking to capitalize on the dynamic world of stock trading.