General Motors (GM) is renowned for its extensive history and significant influence on domestic and global automotive sectors.

GM’s performance is a critical barometer for market analysts and investors in the ever-evolving automotive industry. This piece thoroughly examines GM stock, as evaluated on Fintechzoom, shedding light on its financial health, market position, and prospective outlook.

Given the rapid advancements in electric vehicles (EVs) and autonomous driving technologies, staying abreast of GM’s stock movements is imperative for those seeking informed investment decisions.

This analysis delves into Fintechzoom GM Stock, focusing on recent price fluctuations, insights provided by analysts, and their implications for future market trajectories.

Join us as we explore whether GM presents a prudent investment opportunity in today’s dynamic automotive landscape.

Overview of General Motors’ Stock Performance in 2024

Evolution of Stock Prices

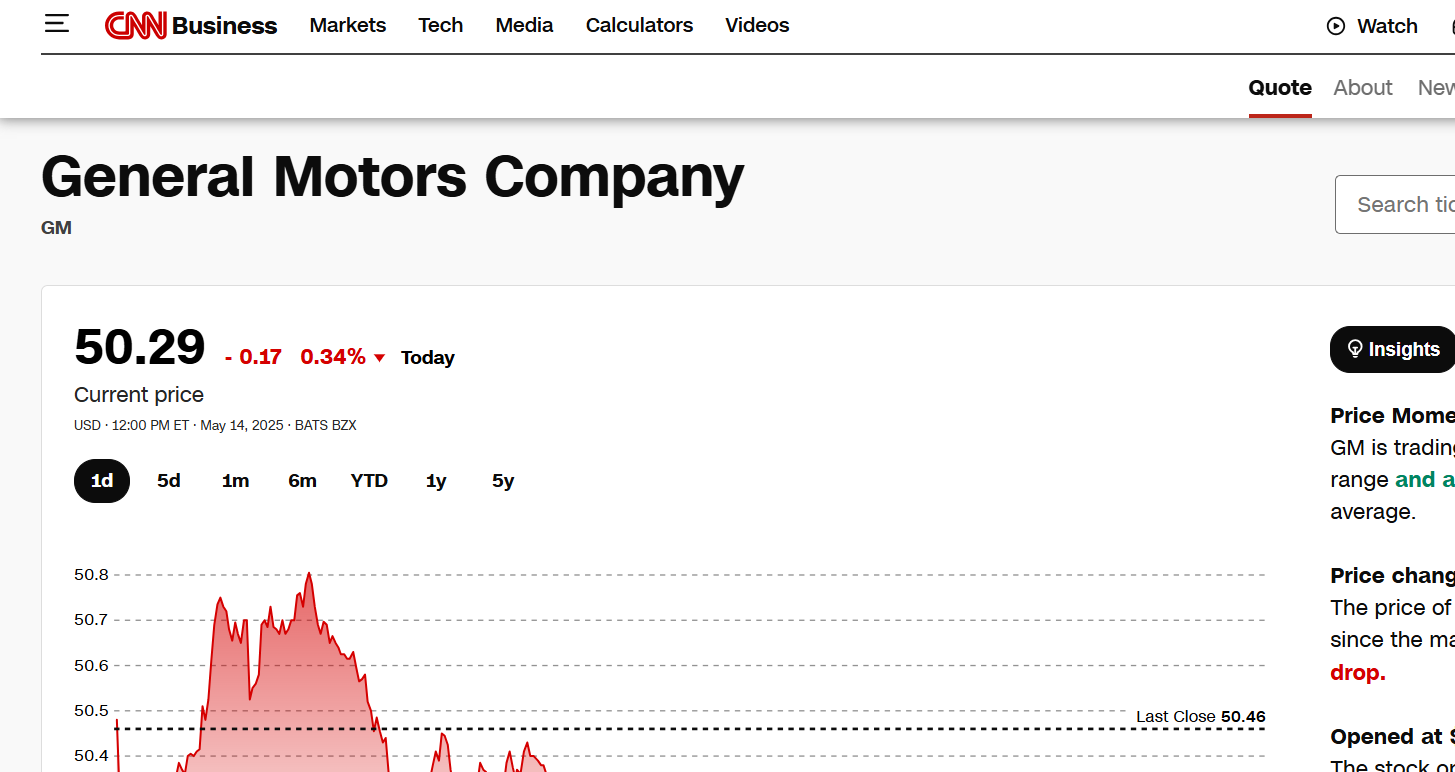

In 2024, General Motors exhibited robust stock performance, indicating considerable investor confidence driven by the company’s strategic initiatives and alignment with market dynamics. Opening the year at $35.92, GM’s stock price surged by 17.6% to reach $42.24.

This uptrend reflects the optimistic sentiment among investors and GM’s adept responsiveness to market demands, particularly in areas like electric vehicles and smart technology.

Analysis of Growth Year-to-Date

In the current year, GM’s stock has surged by 18.15%, surpassing several competitors within the industry.

Despite prevailing economic obstacles and the traditionally unpredictable nature of the automotive sector, this substantial growth highlights the robustness of GM’s stock under such circumstances.

The company’s persistent strategies and capacity to adjust to market changes are proving successful.

Initiatives in Strategy and Market Reaction

General Motors’ stock performance in 2024 is significantly influenced by its emphasis on electrification and autonomous driving. Amidst the evolving landscape of the automotive industry, GM has emerged as a frontrunner in embracing these transformations.

Notably, the company’s investments in electric vehicle manufacturing and autonomous driving technologies through its Cruise unit have garnered attention from investors seeking sustainable, long-term prospects.

The positive market response reflects the confidence in GM’s strategic decisions. Efforts to tackle challenges such as semiconductor shortages and supply chain disruptions have reinforced GM’s position in the market and heightened its attractiveness to investors, laying a foundation for promising growth.

Analyzing General Motors’ Financial Performance

Income and Profit Evaluation

In 2024, General Motors showcased commendable operational prowess and strategic milestones.

Despite a slight decrease compared to the previous year, the latest quarterly revenue of $42.98 billion surpassed expectations, underscoring GM’s resilience amid challenging market landscapes.

GM has sustained its revenue streams admirably through a targeted focus on lucrative segments such as the electric vehicle (EV) market.

Moreover, profitability metrics have been noteworthy, with an estimated net income of $9.9 billion, indicative of adept cost management and operational efficiency.

This profitability achievement, achieved amidst fierce competition and pricing pressures in the automotive sector, is particularly noteworthy.

In the latest quarter, GM achieved earnings per share (EPS) of $1.24, surpassing projections by $0.08. This highlights the company’s robust financial stewardship and operational achievements.

Analysts anticipate a substantial rise in EPS to $9.28 for the entire year, indicating GM’s ongoing endeavors to enhance its product portfolio, optimize manufacturing practices, and explore new markets through innovative automotive technologies.

Anticipated Financial Outlook

General Motors is well-positioned to uphold its financial well-being. The company’s strategic investments in technology and expansion into international markets, especially in electric vehicles and autonomous driving, contribute to its promising outlook for earnings per share.

With a market capitalization of approximately $49.02 billion and a forward price-to-earnings ratio of 4.92 projected for 2024, GM’s stock seems undervalued, drawing the interest of investors prioritizing value.

This financial assessment underscores GM’s stability and capacity for continued growth amid the rapidly evolving automotive landscape.

Analysis of Market Trends and Investor Sentiment

Summary of Market Capitalization

General Motors, boasting a market capitalization of about $49.02 billion, emerges as a formidable presence in the automotive industry. This valuation reflects the collective appraisal investors place on the company, considering its performance and prospects for growth.

General Motors’ enduring valuation amidst the unpredictable automotive landscape underscores investors’ trust in its strategic direction and financial robustness despite the sector’s susceptibility to economic fluctuations and technological progress.

Analysis of the Price-to-Earnings (P/E) Ratio

The price-to-earnings (P/E) ratio is a vital tool for investors, providing insight into how the market evaluates a company relative to its earnings. With GM’s estimated P/E ratio of 4.92 for 2024, there’s an indication that the stock might be undervalued, given its earnings potential.

This appealing P/E ratio could attract investors searching for undervalued opportunities that promise significant returns as the company’s earnings align with its market valuation.

Furthermore, the ratio suggests that despite solid gains, the stock price has yet to fully reflect these earnings, potentially due to broader market uncertainties or specific challenges within the industry.

Investor Sentiment and Views of Stock Analysts

General Motors’ focus on innovation and agility in adapting to market shifts, particularly in electric vehicles and self-driving technologies, has fostered a widespread positive outlook among investors.

Analysts predominantly advocate for buying GM shares, indicating a consensus on the company’s growth prospects, buoyed by its strategic initiatives and solid financial performance.

Moreover, financial professionals have revised their price targets upward, indicating growing confidence in GM’s future trajectory.

This optimistic sentiment from analysts typically encourages more investors to perceive GM as a reliable investment choice, further bolstering market confidence in the stock.

Analyst Ratings and Future Projections from FINTECHZOOM

Present Analyst Evaluations

Analysts at FINTECHZOOM favor General Motors, expressing confidence in its strategic vision and capacity to navigate market changes. Their ratings range from ‘strong buy’ to ‘hold’, with a significant number expressing optimism about GM’s future.

This positive sentiment stems from GM’s advancements in pivotal sectors like electric vehicles (EVs) and autonomous driving technologies, areas anticipated to fuel its expansion.

The widespread endorsement from analysts underscores their belief in GM’s ability to capitalize on these advancements and sustain its competitive edge in the ever-evolving automotive landscape.

Updates on Price Targets with Rationale

Several analysts have increased their price targets in response to GM’s promising advancements and financial strength. For instance, Barclays adjusted its target from $50 to $55, while Morgan Stanley established it at $46, recommending an overweight portfolio allocation.

These revisions stem from GM’s robust financial position and proactive adaptation to emerging automotive trends; factors analysts anticipate will drive the stock’s upward trajectory.

Anticipated Growth Prospects

According to Fintechzoom analysts, there is a consensus on a positive growth trajectory for GM, with an average price target projecting an approximate 18.45% increase from its current stock price.

This projection considers potential risks and rewards, foreseeing GM’s continued growth supported by its investments in technology and international market expansion strategies.

This outlook is fueled by GM’s efforts to expand its footprint in the electric vehicle (EV) market and enhance its autonomous driving technology.

These forecasts reflect the anticipated financial success of GM and the strategic initiatives expected to strengthen its position as a leader in the future automotive industry.

Investment Challenges and Prospects

Primary Investment Risks

Like other major players in the automotive sector, investing in General Motors entails grappling with a range of challenges. A primary concern is the intense competition in the automotive industry, particularly amidst the transition towards electric vehicles (EVs).

GM contends with established rivals like Ford fintechzoom and newcomers like Tesla, Rivian fintechzoom and MULN who prioritize EV innovation. This landscape necessitates continuous innovation and substantial investment from GM to maintain its market position.

Additionally, the automotive industry is susceptible to economic downturns, which can significantly dampen consumer spending on new vehicles.

Moreover, GM is confronting ongoing disruptions in the global supply chain, especially in procuring semiconductors and other vital components. These disruptions can cause production delays and impact sales, affecting GM’s financial performance.

Prospective Investment Prospects

On the flip side, GM presents numerous appealing investment opportunities. The company stands poised to capitalize on the burgeoning electric vehicle (EV) market, having significantly invested in EV and battery technology.

These investments encompass the development of new models and battery plants aimed at reducing costs and enhancing EV efficiency, potentially driving substantial future growth.

Moreover, if you’re seeking a licensed money lender in Singapore, exploring available options for financial assistance can be pivotal in making informed investment choices.

GM’s Cruise division, dedicated to autonomous driving technology, represents another promising avenue for growth. As this technology matures and gains wider acceptance, this division holds the potential to revolutionize transportation and deliver significant returns.

Furthermore, GM’s well-established global brand and extensive market presence offer advantages in both traditional and emerging markets, providing resilience against regional economic fluctuations and facilitating rapid adaptation to evolving consumer preferences.

Closing Remarks and Suggestions

Summarizing the Analysis of GM’s Stock

Our comprehensive examination of “Fintechzoom GM Stock” reveals a cautiously optimistic perspective on General Motors as it navigates the complexities of the global automotive sector.

GM demonstrates robust financial stability, boasting considerable market capitalization and a favorable price-to-earnings ratio, suggesting potential undervaluation of the stock.

The company has strategically bolstered its stock performance, outpacing competitors by leveraging opportunities from the shift towards electric vehicles and autonomous driving technology.

When it comes to the EV industry, Tesla is a big name and most of you must be interested in investing there but before you actually do that, a thorough analysis of the FintechZoom Tesla stock is something that you shouldn’t skip.

Recommendations for Investments

Based on our assessment, General Motors presents itself as a wise investment opportunity, particularly for investors with a long-term perspective amidst the dynamic automotive landscape.

Investors need to recognize GM’s strong financial position and forward-thinking initiatives in burgeoning sectors like electric vehicles (EVs) and autonomous technology, which are poised to drive future growth.

However, it’s imperative to acknowledge the inherent risks associated with the automotive industry, including economic fluctuations, intense competition, and supply chain disruptions.

Adopting a balanced approach is prudent for those considering an investment, integrating GM stock into a diversified portfolio to mitigate potential risks. Continuous monitoring of GM’s innovations and industry trends is crucial.

Staying abreast of quarterly financial updates and sector developments will empower investors to make well-informed decisions at opportune moments.

Final Considerations

To conclude, although the current evaluation of GM stock leans towards a moderate buy recommendation, according to Fintechzoom and other analysts, investors must remain vigilant of both market dynamics and technological shifts impacting the automotive industry.

By staying informed and maintaining a strategically diversified approach, investors can seize opportunities for growth with GM while prudently managing associated investment risks.