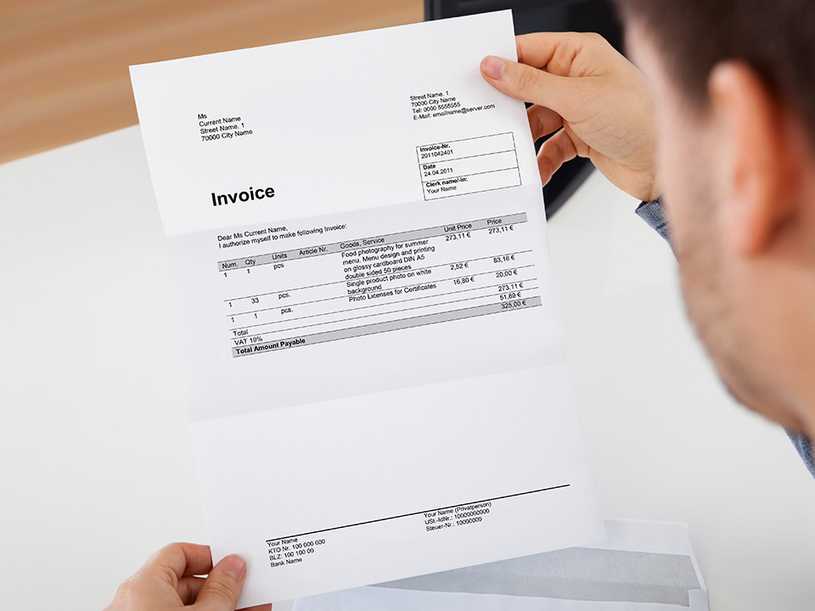

Invoicing typically isn’t a skill they teach in high school, so when you are faced with drafting your first invoice to send to a client, you are probably unsure where to begin. This guide will walk you through the process of creating an invoice that contains all the correct information to ensure you get paid on time and in full by satisfied clients.

The Header

The top of your invoice is arguably the most important, as it contains information that allows you and your clients to keep track of payments. If you make a mistake in the header, your client’s invoice management system might not allow you to get paid, so you need to check and double-check that everything in this section is present and correct before you send your invoice out.

Your Address. You need your client to know right off-the-bat who is sending this invoice. Your name, your company name and your typical contact information should appear first on every invoice.

Recipient address. Even if you do all your work online — which you almost certainly do — you need to address your invoices to the real location of your client business. Most businesses will accept invoices addressed to the name of the company, but some require you to address invoices to the person in charge of accounts payable. You can ask your contact who do address your invoices to at the start of your client relationship.

Identification numbers. There are a few key numbers you need to add to your invoices so you and your clients can keep them straight. A purchase order (PO) number might be supplied by a client as a means of helping verify that your invoice is legitimate. An invoice number is a tool for tracking which invoices you have sent and which have received payment. You can number your invoices however you like; some prefer using dates (like YYYYMMDD) while others use a sequential number.

Branding. Branding is an optional component of invoices. You can send a plain, unadorned invoice — but if you have spent money developing brand assets like logos to make your business more recognizable, you might as well use them on your invoices.

The Body

We were wrong when we said the header was the most important. Because the body of your invoice contains the information that will get you paid, you need to put most of your time and effort toward getting this section right.

Dates. Your invoice should contain two key dates: the date your invoice was created and the date by which payment is due. Including this information is critical for keeping your clients accountable to pay you in a timely manner, and perhaps more importantly, these dates will help you should you need legal support to get paid.

Your Payment Info. This is included in your invoice as a way of telling your clients how and where to send your money — unless you just want a check in the mail. Most people these days use an online payment service like PayPal or Apple Pay, which provides greater security than printing your bank info clear as day.

Payment Terms. You should have negotiated payment terms with your clients as part of the creation of your contract. The typical time frame for payment is 30 days from the invoice date, but if you have a different arrangement with your client, you should remind them of that here.

Calculation Table. This is where you describe the services you performed for your client and tabulate the amount owed. You should try to be as descriptive as possible, so your client understands the purpose of each cost and isn’t surprised by the final sum. You might consider making the total amount owed larger than other information on the invoice, so your client does not have to search for the right figure to pay.

The End

Both the header and the body are critical to communicating information about who you are, who your client is, and what you need from them — but the end could be the most important part of all. Here, you can establish your intention to get paid and your interest to work with these clients again, should the need arise. If you get the conclusion to your invoice wrong, you could damage your professional relationships and reputation.

Legal Disclaimer. A legal disclaimer is not totally necessary, but it can reinforce the gravity of your invoice and compel your clients to pay in full and on time. Your disclaimer can include a reminder about your rights to pursue compensation and that clients unwilling to pay are subject to additional fees and fines.

Sign off. You should always express gratitude toward your clients for working with you. If they feel your appreciation, they will think of you when they inevitably need help again.