It’s important to protect your credit as it influences your monetary life. Using a credit freeze can help you protect your sensitive data and prevent others from accessing your credit file. When you are willing to get a new credit card, apply for a new loan, or rent a house, you may need to unfreeze your credit. In this article, we are going to talk about the way credit freeze works and how to easily unfreeze it if necessary.

The Definition of Credit Freeze

A credit freeze is often called a security freeze. This process is meant to protect the credit file of the person and prevent unauthorized access to their credit report. In other words, identity thieves won’t be able to have access to your credit report or take out a new loan in your name. Hard credit checks won’t be available if you placed a credit freeze on your account.

It only means unauthorized people won’t have access to your report. Companies and lending partners you have an established credit relationship with will still see your credit report if they need it. The credit file or credit history of individuals will also be visible to government companies conducting search warrants or court orders.

There are many credit cards that help build credit so you may seek the most suitable card with bonuses and rewards. This way, your credit will improve while you will also finance important purchases.

How Credit Freeze Works

Consumers can freeze their credit with any of the three major credit reporting agencies – TransUnion, Experian, or Equifax. They may also make a credit freeze with all three bureaus at once. What does it mean? When you freeze your credit, you basically ask these bureaus that you won’t want other people to have access to it. Unauthorized people won’t be able to take new credit or loans in your name. Of course, there are exceptions that we’ve already mentioned.

There is no specific period for a credit freeze. As long as you don’t aim to take out any loans or get new credit cards, it may stay in place to protect your credit report. It used to cost a fee to freeze your credit until 2018. Nowadays, it’s a free process. You can easily freeze and unfreeze your credit on the web and your credit report will be protected.

A credit report is a detailed record of how the individual managed their credit over time. Lending companies use credit reports to define if they are willing to provide them with credit and the amount the borrower will need to pay for it. Besides, landlords, recruiters, and insurance companies use credit reports.

How to Unfreeze Credit with Experian

Consumers have the possibility to unfreeze their Experian credit report temporarily or permanently depending on their needs. This process is quick and easy. Besides, it can be conducted online with just one click. Keep in mind that temporary credit unfreeze will allow lenders to perform a credit pull for a certain period, while a permanent credit unfreeze will make your credit file open for all lenders until you decide to freeze it again.

You can initiate a credit unfreeze:

- By phone: 888-397-3742.

- By mail: Experian Security Freeze, P.O. Box 9554, Allen, TX 75013.

- On the company website.

How to Unfreeze Credit with TransUnion

If you are willing to remove the credit freeze with TransUnion, you may do it on the web. Provided that you have an account with this bureau and a PIN, you may conduct unfreeze yourself. Credit freeze with TransUnion can be removed for particular lenders or for a certain time. Your credit report will remain unfrozen or frozen until the person decides to change this option.

You can initiate a credit unfreeze:

- By phone: 800-916-8800.

- By mail: TransUnion, P.O. Box 160, Woodlyn, PA 19094.

- On the company website.

How to Unfreeze Credit with Equifax

Consumers can easily create a “myEquifax” account on the company web page to unfreeze their credit on the web. This process can be done at any time provided that you have your PIN. Consumers have a chance to unfreeze their credit permanently or temporarily, depending on their needs.

So, you can keep your account unfrozen for just one day or a long period. Those who prefer to remove credit freeze by phone will need to answer several questions to prove their identity. A quick form can be downloaded from the Equifax site to remove credit freeze online. Make sure you can provide copies of your utility bills, Social Security card, and documents to prove your address and identity.

You can initiate a credit unfreeze:

- By phone: 888-298-0045.

- By mail: Equifax Security Freeze, P.O. Box 105788, Atlanta, GA 30348.

- On the company website.

Benefits and Drawbacks of Freezing Your Credit

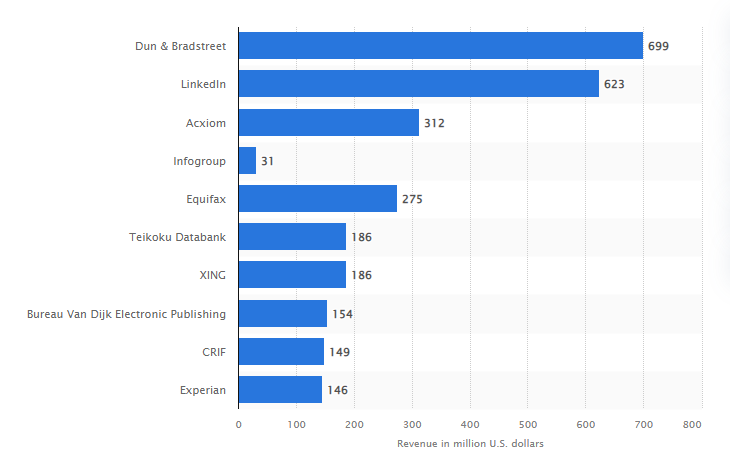

It’s necessary to bear in mind the following benefits and downsides of the credit freeze. The recent statistic demonstrates the leading B2B marketing technology companies around the world in 2016, ranked by income.

Dun & Bradstreet ranked first, having a profit of 699 million U.S. dollars in the measured period. This information will help you make the right decision.

Pros:

- Freezing your credit doesn’t damage your credit score

- Consumers can quickly unfreeze credit on the web

- This process is free of charge

- This process secured the client’s credit report to prevent fraud and identity theft

Cons:

- It’s necessary to remove credit freeze before you apply for new credit cards or loans

- Freezing your credit won’t block full access to your credit report.

Summing Up

Consumers who are concerned about the possibility of fraud or identity theft can benefit from choosing a credit freeze. This process doesn’t demand any fee while removing credit freeze is also fast and secure. You can unfreeze your credit on the web, by phone, or by mail. Removing credit freeze can be done temporarily or permanently. If you are planning to request a new loan or get a new credit card, you should remove the credit freeze in the first place.