Every loan may be stressful. Student loans are no different. It can be frustrating to owe a sufficient sum of money and lose your peace of mind and financial stability because of a student loan.

While you may really need to take out this crediting tool to help you pay for college, it’s necessary to understand how this loan type works and what you should expect from it. Let’s debunk some of the most common student loan myths together.

1. The Interest Doesn’t Accrue While You’re at School

It is one of the most widespread myths about student loans. Consumers believe that the interest doesn’t accumulate while they are still in college. It may sometimes be true, but it usually depends on the student loan type.

If you have taken out the Federal Direct Subsidized Loan, the interest won’t accrue while you are enrolled in college. Besides, you won’t need to pay interest during the grace period. On the other hand, the majority of private student loans, together with Federal Direct Unsubsidized Loans, begin accumulating interest as soon as the loan is disbursed.

So, the interest will accrue even when you are still in college. Keep in mind that interest capitalization happens when the unpaid accrued interest adds to the loan’s principal.

2. You Should Opt for Income-Driven Repayment

There are so many myths concerning student loans and their repayment. You can find a lot of useful information, relevant materials, and updated tips on financial topics on Fitmymoney or other educational platforms. All the information can be used free of charge and help millions of Americans make smart financial decisions.

Income-driven repayment is a plan that bases the borrower’s monthly repayment sum on their family size and income. Some marketers claim that this option is more convenient and easier. You would be surprised to know the truth that you can actually be in debt longer.

Many repayment periods for such repayment plans are between 20 and 25 years, while a monthly payment should be about 10-20% of the borrower’s discretionary income. Are you ready to give this monthly portion of your salary for the next 20 years? You’d better find ways to get rid of your student loan debt as soon as possible.

3. It’s Better to Have a Lower Interest Rate

Of course, interest rates matter. However, you shouldn’t just look at interest rates when you are shopping around for the best lending offer. The term length of the loan may also impact your monthly payment.

The repayment options may also be different from paying the full balance when you are still in college to deferred payments. Private loans may sometimes offer lower interest rates than federal student loans, but the second option offers better borrower protections.

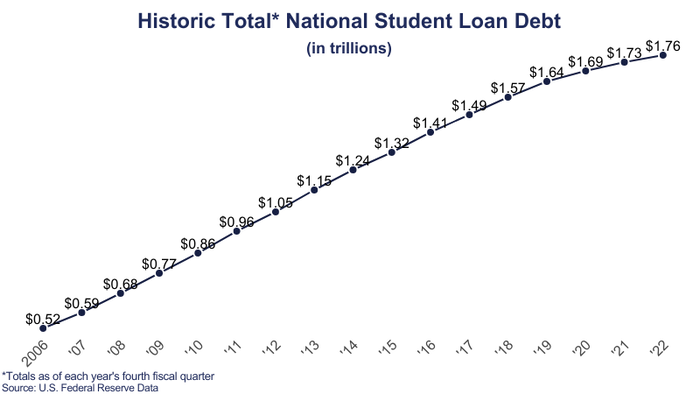

As we can see from the Historic Total National Student Loan Debt chart, the average student loan debt amounted to $1.76 trillion in 2022 compared to $1.05 back in 2012. The national student loan debt increases every year.

4. Every Service Provider Offers the Same Rates

It is another myth that has nothing to do with real life. How can you learn what rates and lending terms other providers can offer if you don’t shop around? It is the only way to understand what conditions you qualify for.

Take some time to do your research. Compare numerous lenders and their offers. Applying for several creditors within 30 or 45 days will count as one credit pulls for credit reporting agencies.

Hence, your credit rating won’t be damaged. Undergraduate students without established credit history or stable income can ask their relatives to be cosigners and help them obtain a student loan.

5. Student Loans Will Remain with Your Forever

Many students are scared that they will have to repay their student loans until they die. It is frustrating and really stressful to think like that. Of course, covering all the debt payments is difficult and fast.

You need to be consistent and determined and follow the repayment schedule. However, if you manage your personal finances, stick to your budget, and make regular payments, you will eventually say goodbye to your debt.

6. Stop Making Loan Payments If You Can’t Afford Them

This myth can be extremely harmful to young students and those who have just graduated and started working full-time. In challenging times and during financial disruptions, it may be tempting to postpone making on-time debt payments until you can afford them again.

In reality, this is a debt trap. Delinquent debt payments will affect your credit rating and damage it. You will spend more time trying to repair your credit, so it’s better to stick to your repayment schedule.

If you select the income-driven repayment plan, it will take your family size and income into account. Depending on the borrower’s current situation, the debt payment might be as low as $0.

7. You Can Refinance Your Debt Only Once

In reality, every borrower has the right to refinance their student loans as many times as they wish. If you are a graduate student, you may decide to refinance your debt to receive a lower interest rate. So your monthly debt payments will be lower. This rule applies especially to medical students since they tend to pay the highest student loans. Thus, refinancing medical student loans is crucial in order to save a significant amount of money in the future.

Later, you may also decide to refinance the loan again, depending on your interest rates and personal finances. Moreover, check additional charges and expenses before you refinance. Stay away from creditors who perform hard credit inquiries on each application, as your credit rating may decrease.

The Bottom Line

Summing up, there are many common myths concerning student loans. You should review the information we’ve covered and check if you also believe in certain myths. Control your finances, have a budget and refinance the loans if necessary.

Never stop paying loans if you are laid off or can’t afford them. It’s better to search for ways to refinance your debt or negotiate new repayment terms with your service provider. Now that you know the truth, you will be able to manage your debt payments and repay existing student loan debt faster and with less effort.