The digitization wave has ushered in a myriad of conveniences, transforming mundane tasks into simple clicks. One such transformation is the ability to deposit checks online, a technological boon allowing users to skip lengthy queues and cumbersome processes at the bank. This article is a compass guiding you through the nuances of online check depositing, enlightening you on navigating this digital banking feature with ease and security.

1. Understand the Prerequisites: Preparing the Groundwork

Before embarking on the journey to deposit checks online, it’s crucial to lay the groundwork by understanding the prerequisites. Most banks necessitate users to have an active online banking account and a compatible mobile device.

The online banking platform is the gateway, and having one’s account set up is the first stride towards utilizing this service. Understanding and satisfying these requirements are akin to having a well-prepared map before embarking on a journey, ensuring a smooth and hassle-free experience in digital banking.

2. Use the Bank’s Official App, The Trustworthy Vessel

Once the prerequisites are met, the next step is to utilize your bank’s official app. Using a legitimate and official app is imperative as it’s the secure vessel steering you through the digital sea of online banking. This ensures the utmost level of security and reliability, protecting sensitive information from the prying eyes of cyber pirates.

This trusted vessel is essential for a safe journey, shielding one’s financial details and personal information ensuring peace of mind while navigating the digital banking waters.

3. Follow the Deposit Process: Charting the Course

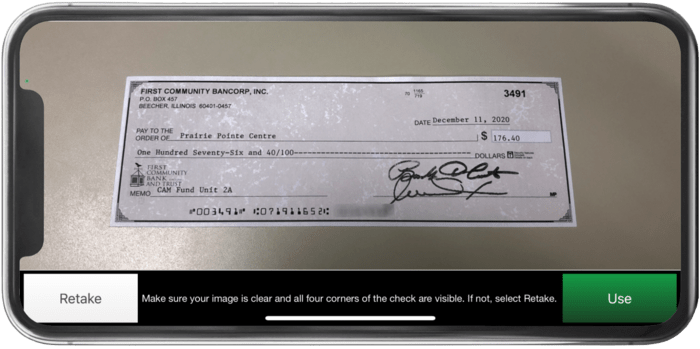

After securing a trustworthy vessel, it’s time to chart the course by meticulously following the deposit process. Typically, this involves logging into the app, selecting the “deposit check online” option, entering the check details, and capturing clear images of both the front and back of the check.

This step is analogous to plotting the right course on a nautical chart, ensuring a straight path toward the destination. Adhering to the process guarantees a successful deposit, avoiding any detours or roadblocks on the digital banking journey.

4. Confirm Transaction and Store the Check: Anchoring Safely

Once the course is charted and the deposit is made, anchoring safely by confirming the transaction and securely storing the check is essential. Users should receive a confirmation from the bank, validating the successful deposit.

Once confirmed, it’s wise to retain the physical check in a secure place until it’s safe to discard it, usually after a stipulated period recommended by the bank. This step is akin to safely anchoring the ship and securing the cargo, ensuring everything is in order and accounted for before disembarking.

5. Review Account Regularly: The Vigilant Lookout

SoFi states, “With mobile deposit, you’re able to deposit funds into your SoFi bank account by simply taking photos of the front and back of the check.”

After successfully depositing the check, maintaining a vigilant lookout by regularly reviewing the account is paramount. It allows users to monitor their transactions and immediately spot discrepancies or irregularities. This vigilant approach acts as the lookout on the ship’s mast, spotting potential threats or obstacles in the path, enabling swift action to rectify any issues. Regular review ensures ongoing security and provides continuous assurance that the financial journey is on the right track.

In the modern digital era, depositing checks online has emerged as a beacon of convenience in the vast ocean of banking services. Users can confidently and confidently navigate the digital banking seas by preparing the groundwork, using the official bank app, accurately following the deposit process, confirming transactions, and maintaining regular account reviews.

When followed diligently, these steps illuminate the path to a seamless online check depositing experience, allowing individuals to harness the full potential of digital banking while safeguarding their financial treasures.