Running an online business in the UK is exciting! However, managing international payments can be a headache. Slow transfers, hidden fees, and complex paperwork eat into your profits and slow you down.

There’s a better way. Virtual IBAN accounts streamline your international payments, saving you time and money. Fondy, a leading B2B embedded payment platform, is at the forefront of this revolution, providing effortless payment solutions to the UK’s freelancers and online sellers.

This article introduces you to the world of virtual IBANs and shows you how Fondy can transform your international business operations.

5 Top Reasons to Opt for a Virtual IBAN Account

Slash Costs, Boost Profits

Ever feel like international payments cost more than they should? You’re not alone. Traditional banks often hit you with a bunch of fees: transfer fees, currency conversion charges, intermediary bank fees – the list goes on! These fees can sneakily eat up a big chunk of your profits, especially for frequent international transactions.

Imagine this: you sell a product to a customer in France. The bank takes a slice of your earnings for the transfer, another slice for converting your pounds to euros, and maybe even a hidden fee for using a partner bank. By the time you see the final amount, your profit margin feels thin.

That’s where Fondy’s virtual IBAN accounts come in. They ditch the hidden charges and surprise fees. Fondy offers a transparent pricing structure, so you know exactly what you’re paying upfront. Their competitive fees are significantly lower than traditional banks, often by a hefty margin.

There are numerous studies that show just how much businesses can save with IBAN. For instance, a recent survey found that online businesses using virtual IBAN accounts saw an average reduction of transaction costs by 50% compared to traditional banking methods.

That’s real money back in your pocket to reinvest in your business, hire new talent, or simply boost your bottom line.

Get Paid Faster

Traditional banking methods often involve lengthy processing times for international transactions. Funds can take days, or even weeks, to clear and reach the recipient’s account. For instance, a survey found that 63% of freelancers have experienced late payments, underlining the need for more efficient financial solutions.

That money could be used to stock up on new inventory, launch a marketing campaign, or even hire that extra team member you’ve been needing. But with traditional banks, those funds are tied up in transit, leaving you in a holding pattern.

This delay is primarily due to the complex network of intermediary banks and correspondent relationships involved in cross-border payments. Moreover, manual verification processes and compliance checks further contribute to the prolonged settlement times, creating frustrating bottlenecks for businesses.

Fondy’s virtual IBAN accounts revolutionize the payment landscape by offering lightning-fast settlement times. Leveraging cutting-edge fintech solutions, Fondy streamlines the payment process, eliminating unnecessary intermediaries and reducing the time it takes for funds to reach your account – no waiting, no delays, just pure business agility.

Faster access to your hard-earned cash translates to smoother operations across the board. With instant settlements, you can plan your finances more effectively, streamline your cash flow, and seize new opportunities without hesitation.

In short, you will be able to reinvest your earnings immediately, secure that bulk discount on supplies because you have the funds readily available, or even offer early payment incentives to your own suppliers.

Built-in Security for Complete Peace of Mind

Virtual IBAN accounts for businesses are designed with robust security measures to safeguard your financial transactions and sensitive data. Unlike traditional methods, virtual IBANs leverage strong encryption to protect sensitive financial data during transactions. This reduces the risk of fraud and unauthorized access.

To top it off, virtual IBANs incorporate multi-factor authentication protocols, further enhancing security by requiring multiple verification steps before transactions can be completed.

These accounts also comply with stringent anti-money laundering (AML) and know-your-customer (KYC) regulations, ensuring that your business operates within legal frameworks and mitigates the risks associated with financial crimes.

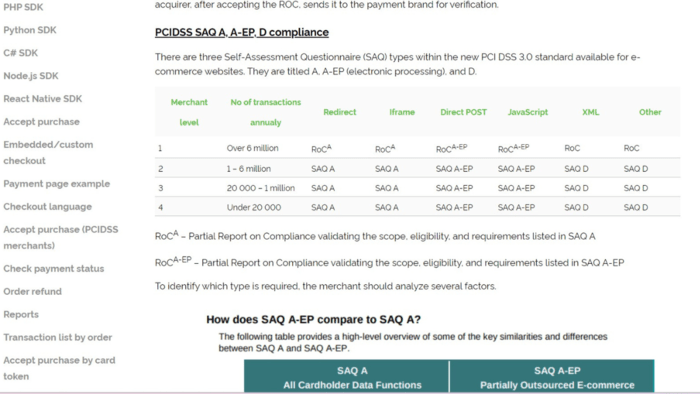

Fondy’s virtual IBAN accounts adhere to the highest international security standards, including PCI DSS compliance for handling sensitive payment data. This strong commitment to security provides businesses with the peace of mind they deserve, enabling them to focus on growth without compromising data integrity.

Failure to comply with the regulations can lead to big fines, cause damage to your reputation, or/and worse, land you in legal trouble. By implementing robust security measures and adhering to compliance standards, virtual IBAN accounts safeguard your business from these risks.

Maintaining a secure and compliant financial ecosystem fosters trust among your customers and partners, positioning your business as a reliable and responsible entity. This trust can translate into increased customer loyalty, better business relationships, and ultimately, long-term success in an ever-evolving global marketplace.

Reconciliation Made Easy

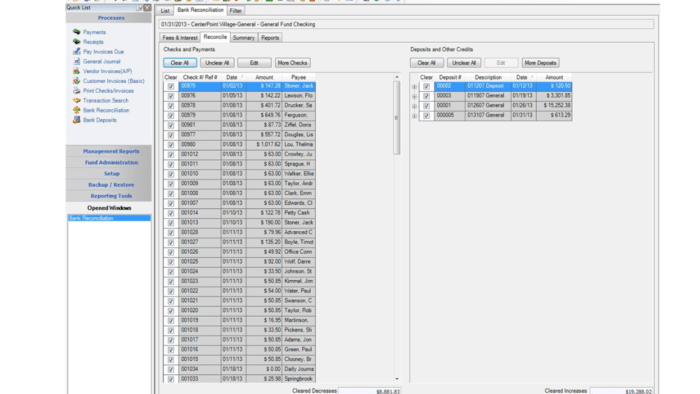

More often than not, reconciling international payments can be messy. Traditional methods often involve sifting through mountains of bank statements, manually matching reference numbers, and chasing down missing information. This time-consuming process diverts focus from core business activities.

Virtual IBAN accounts transform reconciliation into a breeze. Here’s why:

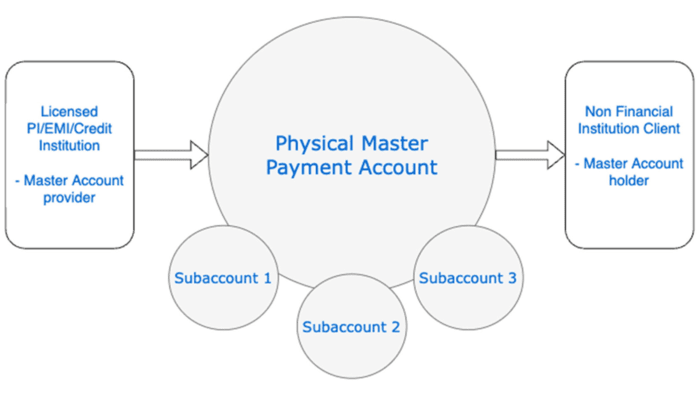

- Unique identifiers: Each virtual IBAN acts as a dedicated identifier for a specific customer or transaction. This eliminates the need to spend hours searching for cryptic reference codes buried within bank statements.

- Automatic matching: Forget manual data entry. Virtual IBAN accounts automatically match incoming payments with the corresponding invoices or orders in your system. This reduces human error and streamlines reconciliation.

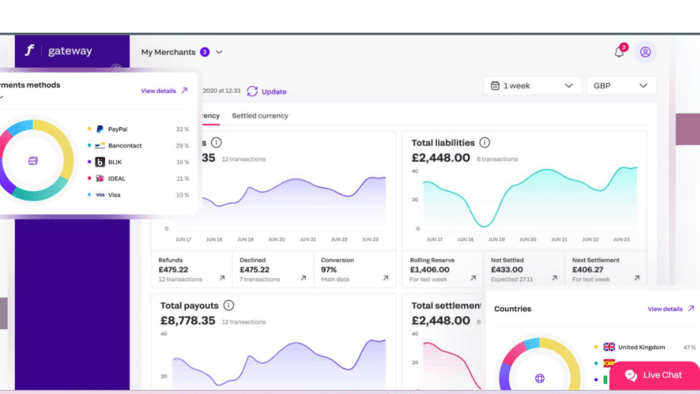

- Real-time visibility: Fondy provides advanced reporting tools offering real-time insights into your international transactions. With a few clicks, you can access detailed breakdowns of payments, identify trends, and monitor cash flow.

If you run an e-commerce platform with hundreds of daily international sales, reconciling these payments would be a huge challenge. However, with virtual IBAN accounts, each customer receives a unique virtual IBAN.

The platform automatically matches incoming payments, eliminating manual work and freeing up valuable staff time for more strategic tasks.

This simplified process translates to significant cost savings and improved operational efficiency, enabling you to invest your full focus on growing your international business.

Accessibility and Integration

For online businesses expanding globally, accessibility and integration are crucial. Imagine the frustration of dealing with complex account setups, clunky interfaces, and incompatible systems. These hurdles can significantly slow down your progress and eat away at valuable resources.

That’s where Fondy steps in, offering a refreshingly different experience. One of the standout advantages of Fondy’s IBAN business accounts is the remarkable ease and speed of the setup process.

Unlike traditional banking channels, which often involve lengthy paperwork and bureaucratic hurdles, Fondy streamlines the account creation process for you.

This means your virtual IBAN account will be ready in just a few minutes!

This seamless experience eliminates the hassle and frustration typically associated with opening new accounts, allowing you to focus your energy on growing your business.

Fondy understands the importance of seamless integration within your existing business ecosystem. Their virtual IBAN accounts are designed to be compatible with a wide range of platforms, software, and systems that your company may already be utilizing.

Whether it’s accounting software, e-commerce platforms, or enterprise resource planning (ERP) systems, Fondy’s virtual IBANs can be effortlessly integrated, ensuring a smooth transition and minimizing disruptions to your operations.

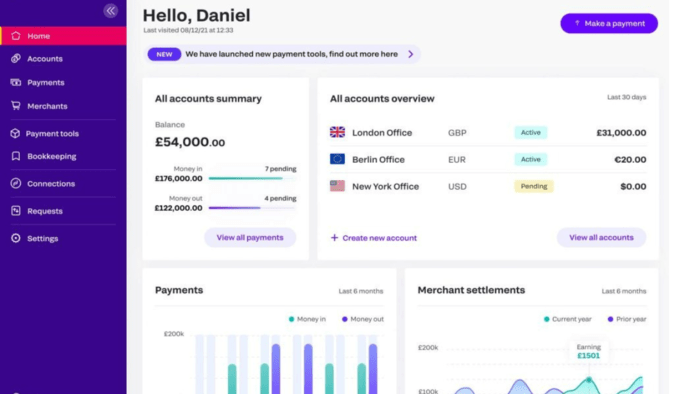

In addition to its robust features and capabilities, Fondy’s platform boasts a user-friendly interface that prioritizes intuitive navigation and ease of use. The clean and modern design allows you to access and manage your virtual IBAN accounts with confidence, eliminating the need for extensive training or technical expertise.

Key Features to Look for in Online Business Accounts

With the UK boasting a thriving online business landscape, choosing the right online business account is crucial for streamlining finances and maximizing growth. Here are the essential features to consider when selecting the perfect account for your needs:

Competitive Fees and Transparent Pricing

Transaction fees can quickly eat into your profits. Prioritise accounts with clear, competitive fee structures that align with your business model. Look for providers that offer transparent pricing with minimal hidden charges for international payments, currency conversions, and account maintenance.

Lightning Fast Settlement Times

Don’t let your hard-earned money get tied up in lengthy settlement periods. Choose an account offering fast settlements, allowing you to receive funds from customers and marketplaces quickly. This ensures a healthy cash flow, facilitates reinvestment in your business, and empowers you to seize new opportunities.

Robust Security and Regulatory Compliance

Security is paramount for any online business. Select an account provider that prioritizes robust security measures. Look for features like multi-factor authentication, encryption protocols, and adherence to international security standards like PCI DSS. Furthermore, ensure your chosen provider operates under relevant UK financial regulations, providing additional peace of mind.

User-Friendly Platform and Intuitive Interface

Managing finances shouldn’t be a chore. Prioritise accounts with user-friendly platforms that are intuitive and easy to navigate. Look for platforms offering clear dashboards displaying transaction history, insightful reporting tools, and seamless integration with popular accounting software or e-commerce platforms you already use.

Seamless Integration with Existing Systems

Streamline your operations with an account that offers seamless integration with your existing business systems. Look for providers whose platforms integrate smoothly with accounting software, e-commerce platforms, and other business tools you rely on.

This eliminates the need for manual data entry and ensures a smooth flow of financial information, saving you valuable time and resources.

Customer Support: Reliable Assistance When You Need It

Even the most intuitive platforms can have hiccups. Choose an account provider with reliable customer support that can address your inquiries and resolve any issues promptly.

Look for providers offering multiple support channels, such as phone lines, live chat, and email support, ensuring you have access to assistance whenever needed.

Additional Services

While not essential, some online business account providers offer additional valuable services. These might include foreign exchange (FX) services with competitive rates, dedicated account managers for personalized support, or built-in invoicing tools to streamline payment collection. Consider these bonus features based on your specific business needs.

By prioritizing these key features, UK online businesses, platforms, and marketplaces can select the perfect online business account to streamline international operations, optimize finances, and propel their business ventures forward.

Fondy’s Business Account: Tailored for Modern Businesses

The needs of modern businesses are constantly evolving. Traditional banking solutions often struggle to keep pace, leaving businesses frustrated with slow processing, limited features, and clunky interfaces.

Fondy’s Business Account addresses these challenges head-on, offering a suite of features designed to streamline your international operations and empower smarter financial decisions.

Faster Access: Get Started in Minutes

Gone are the days of lengthy application processes and waiting weeks for account approval. Fondy streamlines onboarding, allowing you to open an account and start receiving payments within minutes. This rapid setup frees you to focus on what matters most – growing your business.

Instant Settlements: Unlock Positive Cash Flow

Traditional banks often hold onto your funds for days, hindering your cash flow. Fondy breaks this barrier with instant settlements. Receive payments the moment your customer completes their transaction, allowing you to access your funds immediately.

This translates into better financial control, improved agility, and the ability to seize business opportunities as they arise.

Simple and Seamless Payouts

Managing business finances internationally can be a logistical nightmare. Fondy simplifies this process with seamless payouts. Effortlessly send funds to suppliers and partners around the world, all from a single, user-friendly platform. Say goodbye to complex wire transfers and hidden fees.

Effortless Money Management

Take control of your finances with Fondy’s comprehensive money management tools. Enjoy real-time transaction tracking, detailed account breakdowns, and powerful performance analytics.

These insights empower you to make data-driven decisions, optimize pricing strategies, and manage your international cash flow with greater efficiency.

How to Open an IBAN Account With Fondy

Opening a virtual IBAN account with Fondy is a breeze. Here’s a quick overview of the simple steps involved:

- Online Application: Head to Fondy’s website and complete their online application form. The process is quick and straightforward.

- Required Documents: To finalize your application, you’ll need to submit some basic documentation, typically including proof of identity for company directors, proof of business registration, and potentially proof of address.

- Verification and Approval: Once you submit your application and documents, Fondy will conduct a swift verification process. Upon approval, you’ll receive a notification and be ready to start using your virtual IBAN account.

The entire process can be completed within minutes, allowing you to begin receiving international payments and managing your finances efficiently.

In Conclusion

In today’s globalized marketplace, managing uninterrupted cash flow globally poses a massive challenge for UK online businesses.

Slow settlements, high fees, and complex reconciliation processes hinder cash flow and growth. Virtual IBAN accounts from Fondy offer a powerful solution, streamlining operations, boosting efficiency, and unlocking a world of growth opportunities.

Fondy’s virtual IBAN accounts offer a streamlined alternative. Enjoy instant settlements, simplified reconciliation, and competitive fees, all through a user-friendly platform.