In a world where data is more accessible than ever, it’s no surprise that data-driven banking is rising. This new approach to banking relies on data analytics to make automated decisions about lending, investment, and other financial transactions.

This article explains the value of AI and machine learning for banks, particularly in data-driven banking.

The Importance of Data in Banking

In recent years, we’ve seen a growing trend toward data-driven banking, where financial institutions use data to make more informed decisions about their products, services, and strategies. This shift is being driven by technological advances, making it easier for banks to collect and analyze data. And as consumers become more accustomed to digital channels and mobile devices, they’re also becoming more comfortable sharing their data.

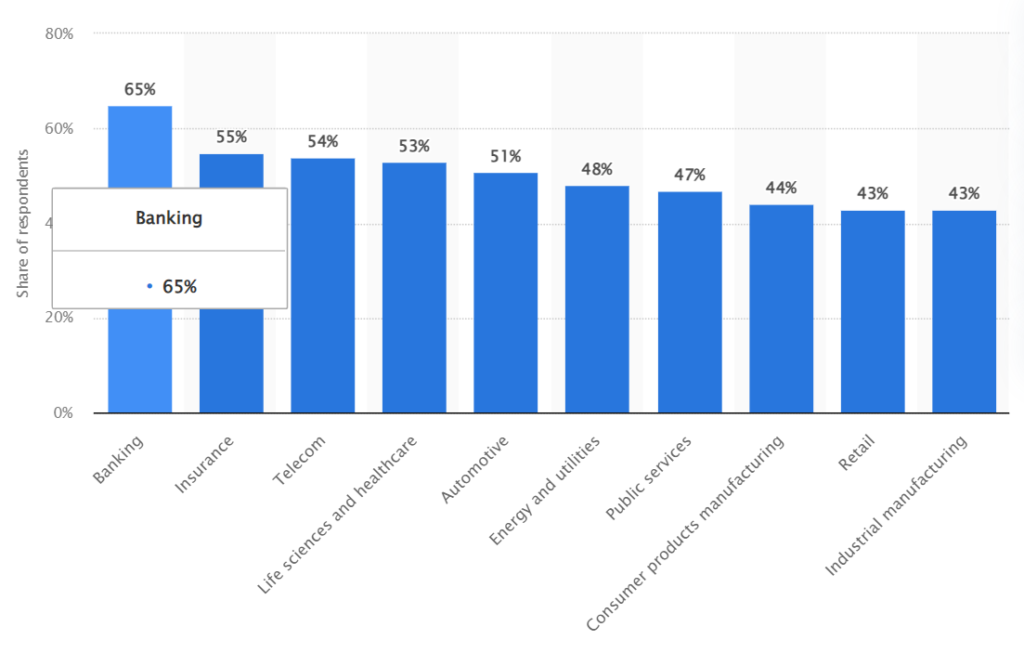

According to 65% of positive responses, the banking industry outperformed all other industries in 2020 in terms of data-driven decision-making within firms.

Data is a critical business enabler of the provision of value to customers. Banks today are leveraging data to provide a better experience and better service. For example, digital banks are building a better digital experience for their customers using data insights. They can also use data to identify trends and opportunities and to make more informed decisions about where to invest their resources.

In addition, data-driven banking can help to reduce fraudulent activity by quickly identifying suspicious behavior.

Data is at the heart of everything financial institutions do. The secret is to add value by utilizing data to:

- Develop clever interactions: Data is crucial to the quality of customer interactions. For example, banks can build a better digital experience for their customers using data insights. Data also helps to improve the quality of service for existing clients. For example, by using data insights, banks can identify which customers require a more hands-on approach, thereby improving the experience for those who prefer to be contacted via email or text.

- Create digital-native products: By updating infrastructure and working with outside suppliers through open architectural models employing the cloud, digital-native goods can be produced. This will eventually assist in lowering product costs. For instance, the Spanish bank BBVA used this philosophy to develop Valora, a complete home-buying solution that lowers costs for both the bank and the end user.

Read: managed it services what can you expect from external software providers

What is Data-Driven Banking?

Data-driven banking is a term used to describe the use of data analytics to make decisions in the banking industry. Data analytics is the process of examining large data sets to identify patterns and trends. Banks have access to large amounts of data, including customer transaction history, credit scores, and account balances. By analyzing this data, banks can gain insights into customer behavior and preferences.

This information can be used to make a product, service, and marketing decisions. This includes customer segmentation, fraud detection, and risk management. For example, data-driven banks may target specific areas for marketing campaigns based on customer demographics. Data-driven banking is a relatively new concept, but it’s becoming increasingly important as banks strive to compete in a digital world.

Data-driven banking also involves building a digital ecosystem on GAFA where financial products and digital services are sold through the platform, which in turn helps to create a better experience for the end customer. For example, data can be used to design automated customer service experiences that provide better service at a lower cost. By harnessing the power of data, banks can make more informed decisions that can help them improve customer experience, reduce costs, and stay ahead of the competition.

Read More: Make Money Online Today: Four Genuine Ideas

Building Data into the Blueprint of New Banks

Digital and traditional banks have to use data analytics through agile tech stacks (cloud-based databases, middleware, and software as a service) to transform their business models and reach hyper-personalization. Leveraging data-driven tools from an agile IT stack, financial institutions can maximize capital allocation and reduce risks. This is relevant to virtual banks with a growth trajectory to ensure that risk and profitability are strategically linked. To acquire a real-time picture of the bank’s operations, all levels and departments require the mastery of data, which data-driven solutions make possible.

According to 66% of global banking executives, success depends on the alignment of financial performance and risk data, Research from Oracle and Asia Risk states.

The convergence of risk, financial, and performance management initiatives is made possible through a shared analytics platform. Intelligent analytical apps can connect outcomes on their own and draw conclusions from data from many corporate functions, platforms, and channels. Data must be moved out of silos and into a streamlined ecosystem with solid data governance rules to establish a modern data architecture incorporating powerful analytics and AI.

Deployment of Data-Driven Capabilities for Financial Services

To successfully deploy data-driven capabilities, organizations need to take a holistic view of their data and understand how it flows through the organization. They also need to identify gaps in their data infrastructure and put processes in place to ensure that data is properly collected and managed. Only then can they begin to harness the power of data to drive better decision-making and improve financial performance.

To evolve into a data-driven bank, you need to:

- Consider your use cases before considering the necessary technology. Create your data-driven model with your company goal in mind.

- To support your overall plan, create a value realization unit. Create a roadmap by prioritizing use cases.

- Build intelligent data platform capabilities that are use-case-driven since an agile strategy demands them. The moment has passed for creating an entirely new data architecture.

- Make sure the agile strategy is in line with the overall plan. From a technological standpoint, the design authority will have to ensure that all structural components are developed according to the bank’s future and target data technology vision.

- Adjust your organizational structure to the use cases. Use the use cases as the inspiration for internal change.

- Banks have the potential to become the hub of data-centric systems and the main force behind cultural transformation if they have the correct foresight.

As the financial landscape continues to evolve, data-driven banking is likely to play an increasingly important role. The only challenge for banks is working with peers—or even rivals—to find solutions to issues.