You don’t have to wait for thunderboltcasino.com to fall into your lap in order to start a small business. After you acquire the funding through loans, investments, venture capital or other sources you can start off slowly in your basement office and build up from there.

The Small Business Administration was created in 1953, as an independent agency of the Federal Government, to assist new entrepreneurs who have the guts and the vision to start something new. The SBA’s mission is to “aid, counsel, assist and protect the interests of small business concerns, to preserve free competitive enterprise and to maintain and strengthen the overall economy” of the United States.

The SBA was created as part of the Small Business Act of July 30, 1953. One of the goals of the SBA was to ensure that small businesses receive a “fair proportion” of government contracts and sales of surplus property. The Small Business Investment Company (SBIC) program, established under the Investment Company Act of 1958, licenses, regulates and helps provide funds for privately owned and operated venture capital investment firms. The Equal Opportunity Loan (EOL) Program of 1964 relaxed the collateral and credit requirements to encourage new low income entrepreneurs to establish businesses that were unable to attract financial backing.

What Can you Expect from the SBA?

If you have a good idea and think that you can make a go of it, you have support from the SBA. The SBA offers support in numerous ways, including.

- Specialized training how to start a business, business planning, finances and accounting for a small business, business management, marketing and advertising, government contracting and how to survive a small economy.

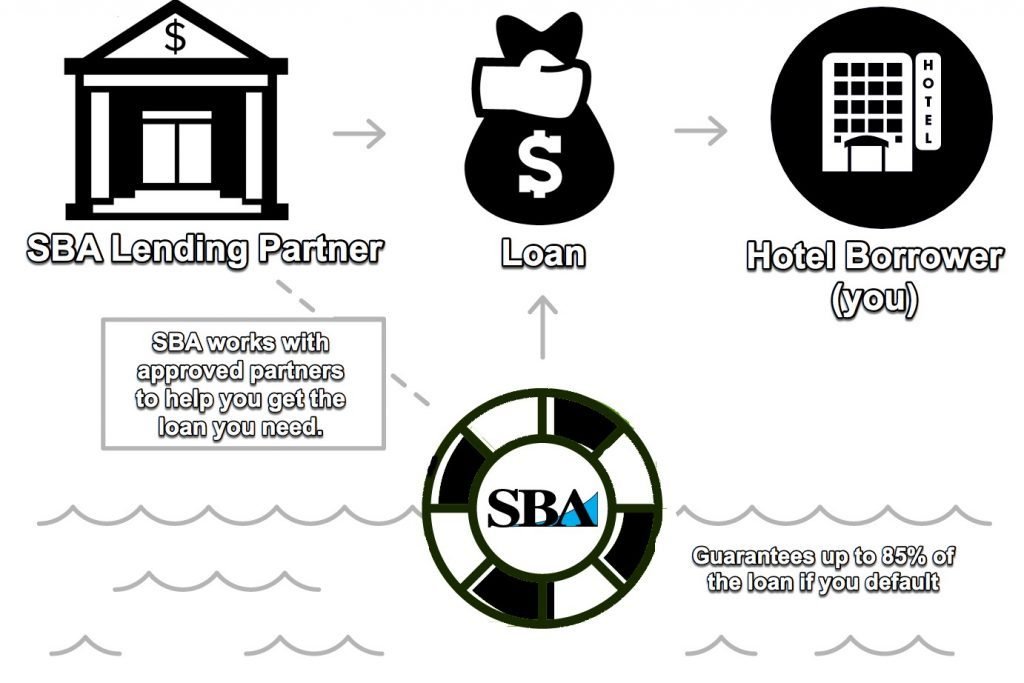

- Federal and financial contract procurement assistance including loans to victims of natural disasters. SBA does not make loans itself but it does guarantee loans made to small businesses by other institutions and individuals. As a result of this guarantee lending institutions are willing to offer a number of loan programs to those who can fulfill sba loan qualifications and get get their small businesses off the ground.

- Contractual opportunities to small business which might not otherwise have access to such opportunities. Since the Federal Government is the world’s largest buyer of goods and services, they empower small businesses via the SBA by giving them the opportunity to bid on contracts for some of these purchases. The SBA’s goal is that at least 23 percent of all government buying will be taken care of by small firms.

- Information that can help the small business owner position a company for contracting abilities through information about how to buy from and sell to the government. The guide “For Small Business Owners” shows small business owners how to get started and pursue opportunities.

- Information that targets minority entrepreneurs including women, veterans, Native Americans and 50+ new small business owners.

- A law library with SBA reports, records, studies, statistics and information on the latest laws and regulations about the National Ombudsman, Small Business Advocacy, Hearings and Appeals and the Law Library.

- Programs and resource partners that provide counseling and training to small business owners. These programs include the the Office of Small Business Development Centers and SCORE Association (Service Corps of Retired Executives).

Getting Started

To optimize the SBA:

- Start by reviewing the SBA’s “Starting a Business” landing page. The webpage offers numerous articles such as “Is Entrepreneurship for you?” and then the helpful “20 Questions Before Starting a Business.” These articles will help you focus your business’s reach, target clientele and abilities, at least at the initial stage of operations.

- Do some in-depth research. The SBA makes the data that comes from the U.S. Census Bureau, the Bureau of Labor Statistics and the Federal Trade Commission real and collates it into readable, understandable language that will help you apply the information to your project.

- Identify the various government programs that support each type of business. Keep in mind that if you belong to a particular group (for instance, “older” entrepreneurs of 50+) you might qualify for various types of support or subsidies. Understanding the category that your impending business falls under as well as any eligibility that you may have for assistance can give your budding business a big boost. The SBA website offers an extensive list of government grants and loans that you can apply for.

- Write up a business plan. Securing funding for your business is dependent on your business plan, so do a good job. You can use the SBA website to find suggestions and sample outlines that will allow you to create a professional, compelling business plan that will impress supporters and funders.

- Find a mentor who has a small business and can guide you as you start out. Many professional and trade organizations offer mentorship programs. A good mentor can hold your hand through the tricky waters of launching a new business and help you navigate the process more smoothly and with greater success.

- Research the legal rules and requirements of your business, both the rules of your specific business (i.e. safety regulations, if they apply) and the regulations that apply to all businesses (i.e. taxes, zoning, etc). The SBA doesn’t offer legal advice but the site does provide an overview of some of the laws and statues. that are specific to small businesses as well as an overview of some of the most common legal issues that new business owners face.

- Prepare for your new business’s taxes BEFORE you start working. Tax filing as a business owner is more complicated than as an individual so even if you have an accountant or bookkeeper who will help you, you should know what to expect. The SBA site details some of the most commonly asked questions about business taxes and runs a forum where users can share information amongst themselves as well as with SBA guides.

Growing

The SBA stays with you as you start to grow your business providing the following services:

1. A learning center with free videos and courses that help you with marketing and finance.

1. A learning center with free videos and courses that help you with marketing and finance.

2. Marketing plan development through videos and online courses and the “How to Develop a Marketing Plan?” article.

3. An “Analyze your Business” tool that gives you valuable data regarding your industry based on your location. Information includes industry benchmarks, data on competitors and suggestions for targeted advertising. Customize by entering information that is specific to your business (address, products/services, etc).

4. Email updates from the SBA that include business tips and upcoming local business events.

5. Access to local SBA offices where staff members can assist. There is also targeted assistance available for businesses run by women, minority groups, etc.

6. Access to SBA lenders who can help you grow your business with loans and investment programs. Fill out the SBA LINC form. The form will be reviewed by SBA-approved lenders who then reach out to small businesses with which they may be interested in working. If your business is interested, you develop the relationship with the lender and move forward from there.